Introduction

Planning for retirement requires careful consideration of investment strategies that can generate reliable income to sustain your lifestyle during your golden years. While there’s no one-size-fits-all approach, there are several investment strategies you can implement to create a steady stream of retirement income. In this article, we’ll explore the top 5 investment strategies for retirement income, empowering you to build a financial foundation for a secure and comfortable retirement.

1. Dividend Investing

Dividend investing involves purchasing stocks of companies that pay regular dividends to shareholders. These dividends can provide a consistent source of passive income during retirement, as companies typically distribute profits to shareholders on a quarterly basis. By focusing on dividend-paying stocks with a history of consistent payments and dividend growth, investors can build a portfolio that generates reliable income streams to support their retirement lifestyle.

2. Real Estate Investment

Investing in real estate can be an effective strategy for generating rental income and building long-term wealth. Whether through rental properties, real estate investment trusts (REITs), or crowdfunded real estate platforms, real estate investments can provide a steady stream of passive income during retirement. Additionally, real estate investments offer the potential for capital appreciation and tax benefits, making them a popular choice among retirees seeking to diversify their investment portfolios.

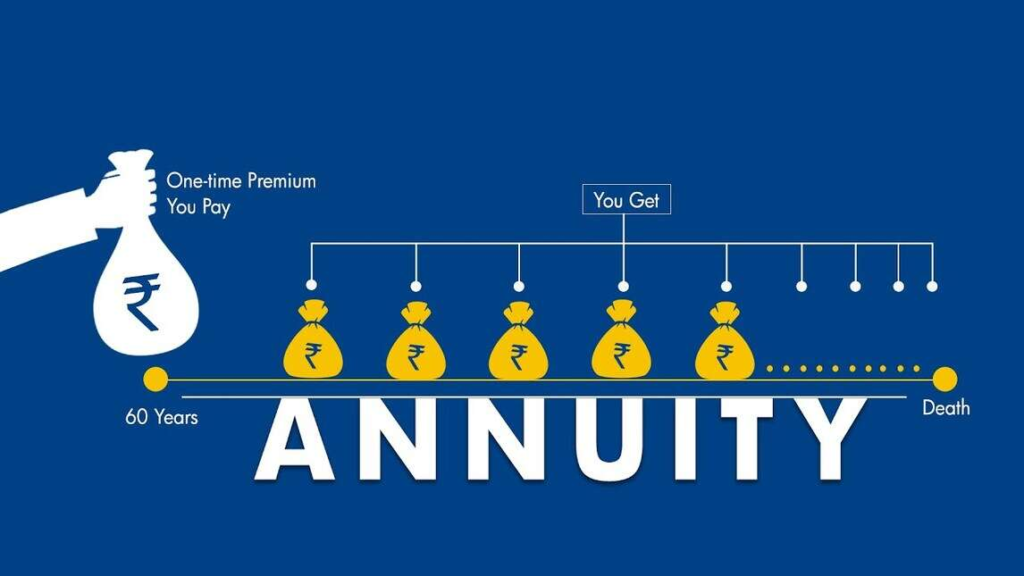

3. Annuities

Annuities are financial products offered by insurance companies that provide guaranteed income payments for a specified period or for life. With annuities, retirees can create a reliable source of retirement income that is not subject to market fluctuations. There are various types of annuities available, including immediate annuities, deferred annuities, and indexed annuities, each offering different features and payout options to suit individual retirement needs.

4. Bonds

Bonds are fixed-income securities that pay periodic interest payments to investors until maturity, at which point the principal amount is returned. Investing in bonds can provide retirees with a steady stream of income while preserving capital and reducing investment risk. Bonds offer a range of options, including government bonds, municipal bonds, corporate bonds, and treasury inflation-protected securities (TIPS), allowing retirees to tailor their bond investments to their risk tolerance and income needs.

5. Retirement Accounts

Retirement accounts such as 401(k)s, IRAs, and Roth IRAs are essential vehicles for building retirement income. By contributing to these tax-advantaged accounts during your working years and strategically withdrawing funds in retirement, you can create a sustainable income stream to support your lifestyle. Utilizing retirement accounts allows you to benefit from tax-deferred or tax-free growth, maximize investment returns, and ensure a secure financial future in retirement.

FAQs (Frequently Asked Questions)

What is the difference between a traditional IRA and a Roth IRA?

The main difference between a traditional IRA and a Roth IRA lies in how they are taxed. With a traditional IRA, contributions may be tax-deductible, and earnings grow tax-deferred until withdrawal, at which point they are taxed as ordinary income. In contrast, Roth IRA contributions are made with after-tax dollars, but withdrawals in retirement are tax-free, providing tax-free income during retirement.

Can I invest in dividend-paying stocks through retirement accounts?

Yes, you can invest in dividend-paying stocks through retirement accounts such as IRAs and 401(k)s. By holding dividend-paying stocks within retirement accounts, you can benefit from tax-deferred or tax-free growth on dividends, allowing you to maximize your investment returns and build a reliable income stream for retirement.

What are the risks associated with investing in real estate for retirement income?

While real estate can be a lucrative investment for generating retirement income, it also comes with risks, including property market fluctuations, vacancies, maintenance costs, and liquidity constraints. It’s essential for retirees to conduct thorough research, diversify their real estate investments, and consider their risk tolerance before committing to real estate as a retirement income strategy.

How do I choose the right annuity for retirement income?

Choosing the right annuity for retirement income depends on your individual financial goals, risk tolerance, and income needs. Consider factors such as the type of annuity, payout options, fees, and surrender charges when evaluating annuity options. Consulting with a financial advisor can help you determine the most suitable annuity strategy for your retirement plan.

Are bonds a safe investment for retirement income?

Bonds are generally considered safer investments compared to stocks, as they offer fixed income payments and a lower level of volatility. However, bonds are still subject to risks, including interest rate risk, credit risk, and inflation risk. Retirees should diversify their bond investments and carefully consider their risk tolerance and investment objectives when incorporating bonds into their retirement income strategy.

Conclusion

Generating retirement income requires careful planning and strategic investment decisions to ensure financial security and peace of mind during your golden years. By implementing the top 5 investment strategies for retirement income, including dividend investing, real estate, annuities, bonds, and retirement accounts, you can create a diversified portfolio that generates reliable income streams to support your retirement lifestyle. Start planning and investing early to maximize your retirement savings and enjoy a comfortable and fulfilling retirement.