Introduction

Millennials, typically defined as individuals born between 1981 and 1996, face unique financial challenges shaped by economic factors, societal trends, and technological advancements. From navigating student loan debt to grappling with stagnant wages and rising living costs, millennials confront a myriad of financial obstacles on their journey to financial security. In this article, we’ll explore the top 5 financial challenges facing millennials and provide insights into how they can overcome these hurdles to achieve their financial goals.

1. Student Loan Debt

One of the most significant financial challenges facing millennials is the burden of student loan debt. With the rising cost of higher education, many millennials graduate with substantial student loan balances, making it challenging to achieve other financial milestones such as buying a home or saving for retirement. The burden of student loan debt can delay major life decisions and hinder long-term financial stability.

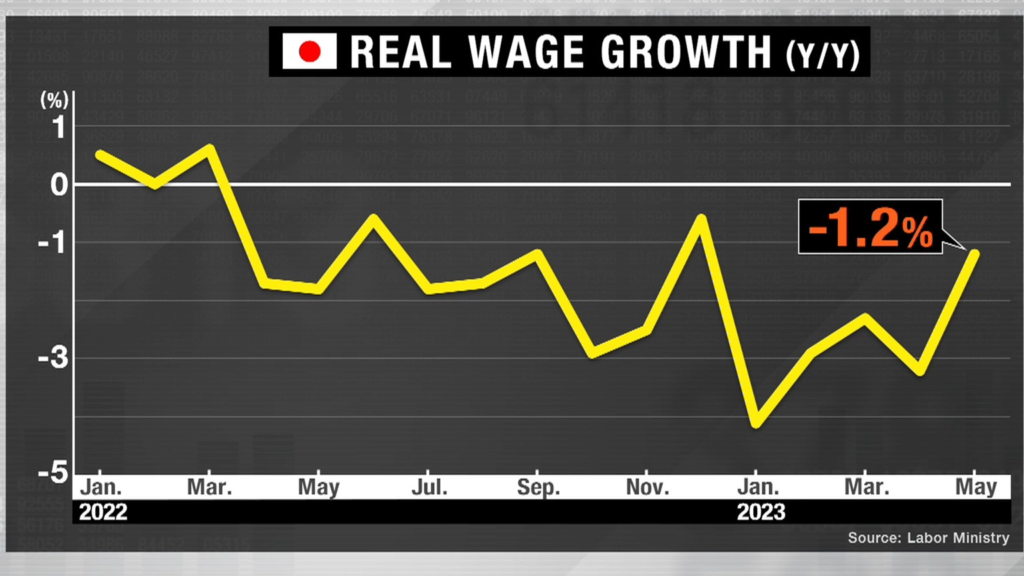

2. Stagnant Wages

Despite being the most educated generation in history, millennials often face stagnant wages and limited job opportunities, particularly in the aftermath of the 2008 financial crisis and the ongoing effects of the COVID-19 pandemic. Many millennials struggle to find well-paying jobs that match their education and skills, leading to financial frustration and difficulty making ends meet.

3. Housing Affordability

Housing affordability is a significant concern for millennials, especially in urban areas where housing costs have skyrocketed relative to income levels. High rents and soaring home prices make it challenging for millennials to afford suitable housing, forcing many to delay homeownership or rely on alternative living arrangements such as renting with roommates or living with family members.

4. Saving for Retirement

Despite the importance of saving for retirement, many millennials face obstacles in building adequate retirement savings. With competing financial priorities such as student loan payments, housing expenses, and healthcare costs, saving for retirement often takes a backseat. Additionally, the shift away from traditional pension plans towards self-directed retirement accounts places the onus on individuals to proactively save and invest for their future.

5. Managing Credit Card Debt

Credit card debt is a prevalent issue among millennials, who often rely on credit cards to bridge financial gaps or fund discretionary spending. High-interest rates and minimum monthly payments can quickly spiral out of control, leading to long-term debt and financial stress. Millennials must develop responsible spending habits and strategies for managing credit card debt to avoid detrimental impacts on their financial health.

FAQs (Frequently Asked Questions)

How can millennials tackle student loan debt?

Millennials can tackle student loan debt by exploring repayment options such as income-driven repayment plans, refinancing at lower interest rates, and prioritizing high-interest loans for accelerated repayment. Additionally, increasing income through side hustles or pursuing higher-paying job opportunities can expedite the repayment process.

What steps can millennials take to increase their earning potential?

To increase their earning potential, millennials can invest in their education and skills through continued learning, professional development, and certifications. Networking, building a strong personal brand, and seeking out mentorship opportunities can also open doors to higher-paying job opportunities and career advancement.

How can millennials overcome housing affordability challenges?

Millennials can overcome housing affordability challenges by exploring alternative housing options such as co-living arrangements, house hacking, or relocating to areas with lower housing costs. Additionally, saving for a larger down payment, improving credit scores, and exploring first-time homebuyer programs can increase affordability and accessibility to homeownership.

What are some strategies for millennials to save for retirement?

Millennials can save for retirement by contributing to employer-sponsored retirement plans such as 401(k)s or 403(b)s, taking advantage of employer matching contributions, and automating contributions to retirement accounts. Additionally, opening individual retirement accounts (IRAs) and investing in low-cost index funds or target-date funds can help millennials build long-term wealth.

How can millennials avoid falling into credit card debt traps?

To avoid falling into credit card debt traps, millennials should create a budget, track their spending, and prioritize paying off high-interest credit card balances. Using cash or debit cards for purchases, setting spending limits, and avoiding impulse purchases can also help curb unnecessary credit card spending.

Conclusion

Millennials face a myriad of financial challenges, from student loan debt and stagnant wages to housing affordability and retirement savings. By understanding these challenges and implementing proactive strategies for overcoming them, millennials can take control of their financial futures and achieve long-term prosperity. Whether it’s tackling student loan debt, increasing earning potential, or saving for retirement, millennials have the resilience and resourcefulness to navigate these challenges and build a solid foundation for financial success.