Introduction

Saving money can be challenging, especially with the temptations of daily expenses and impulse purchases. Fortunately, there are apps available that can help you automate your savings and effortlessly reach your financial goals. In this article, we’ll explore the top 5 apps for automating savings, empowering you to take control of your finances and build a secure financial future.

1. Acorns

Acorns is a micro-investing app that rounds up your everyday purchases to the nearest dollar and invests the spare change into a diversified portfolio of exchange-traded funds (ETFs). With Acorns, you can automate your savings effortlessly by linking your debit or credit cards to the app and setting up recurring contributions. Additionally, Acorns offers personalized investment recommendations and retirement accounts to help you grow your savings over time.

2. Digit

Digit is an intelligent savings app that analyzes your spending habits and automatically transfers small amounts of money from your checking account to your Digit savings account. Using machine learning algorithms, Digit calculates the optimal amount to save based on your income, expenses, and financial goals. With features like overdraft prevention and unlimited withdrawals, Digit makes saving money effortless and stress-free.

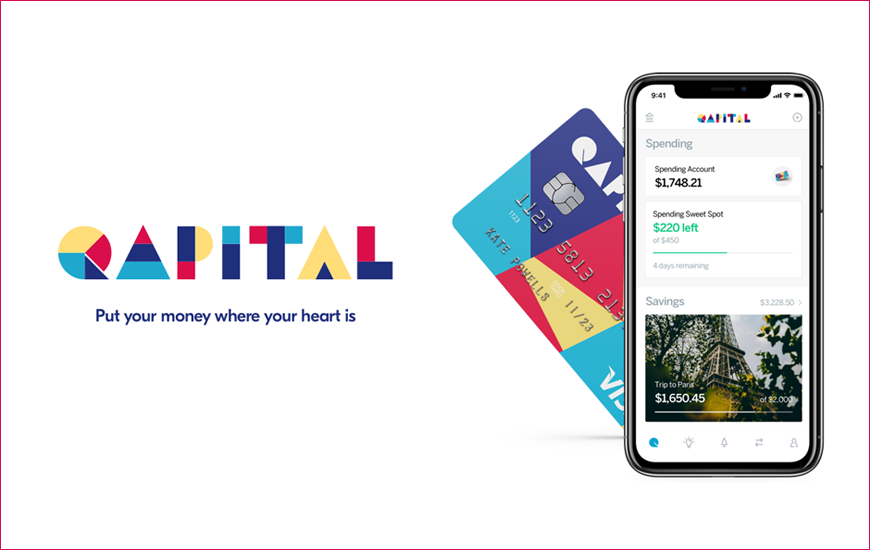

3. Qapital

Qapital is a goal-based savings app that helps you set and achieve your financial goals through automated savings rules and personalized savings plans. With Qapital, you can create savings goals for various purposes, such as vacation, emergency fund, or debt repayment, and set up rules to automatically transfer money to your savings account based on your spending habits and preferences. Qapital also offers features like round-up savings, spending insights, and customizable savings rules to help you reach your goals faster.

4. Chime

Chime is a mobile banking app that offers a variety of features to help you automate your savings and manage your finances more effectively. With Chime’s Automatic Savings program, you can set up recurring transfers from your Chime Spending Account to your Chime Savings Account on a weekly or monthly basis. Additionally, Chime offers features like round-up savings, paycheck advance, and early direct deposit to help you save money and avoid overdraft fees.

5. SmartyPig

SmartyPig is an online savings account that allows you to set savings goals and automate your contributions towards achieving them. With SmartyPig, you can create multiple savings goals for different purposes, such as travel, home renovation, or education, and set up recurring transfers from your checking account to your SmartyPig savings account. SmartyPig also offers competitive interest rates and no monthly fees, making it an attractive option for automating your savings and growing your money over time.

FAQs (Frequently Asked Questions)

Are these savings apps safe to use?

Yes, reputable savings apps employ encryption and security measures to protect your personal and financial information. Additionally, most savings apps are FDIC-insured or use bank-level security protocols to ensure the safety of your funds. However, it’s essential to research and choose reputable apps with strong track records and positive user reviews to minimize security risks.

Can I withdraw money from my savings accounts with these apps?

Yes, most savings apps allow you to withdraw money from your savings accounts at any time, although some may have restrictions or withdrawal limits. Additionally, some apps may charge fees or penalties for early withdrawals or excessive transactions, so it’s essential to review the app’s terms and conditions before making withdrawals.

Do these apps charge fees or commissions?

While some savings apps offer free basic accounts, others may charge fees for premium features or services. Common fees may include monthly maintenance fees, transaction fees, or account minimums. It’s essential to read the app’s fee schedule and terms of service carefully to understand any potential costs associated with using the platform.

Can I link multiple bank accounts to these savings apps?

Yes, many savings apps allow you to link multiple bank accounts to the app to facilitate transfers and automate savings. By linking multiple accounts, you can consolidate your finances and manage your savings more effectively. Additionally, some apps may offer features like account aggregation and spending analysis to provide a comprehensive view of your financial picture.

Are there any minimum deposit requirements for these savings apps?

Some savings apps may have minimum deposit requirements or account balances to open an account or access certain features. However, many apps offer low minimums or even allow you to start saving with as little as $5 or less. Check the app’s requirements and eligibility criteria to determine if it’s suitable for your savings goals and budget.

Conclusion

Automating your savings can help you achieve your financial goals faster and more efficiently by removing the guesswork and discipline required to save money manually. By leveraging the top 5 apps for automating savings, including Acorns, Digit, Qapital, Chime, and SmartyPig, you can streamline your savings process, build a healthy financial habit, and work towards achieving financial freedom and security.